Study Notes: Customer Lifetime Value (CLV)

Study Notes: Customer Lifetime Value (CLV)

1. Introduction to CLV

Customer Lifetime Value (CLV) is a prediction of the net profit attributed to the entire future relationship with a customer. It is a core metric in Customer Relationship Management (CRM), helping businesses evaluate the long-term impact of customer acquisition, retention, and referral strategies (Buttle & Maklan, 2019).

-

Focus: Relationship value, not just individual transactions

-

Importance: Assesses the cost-effectiveness of retention vs. acquisition

-

Strategic Use: Drives segmentation, personalisation, and budgeting decisions

2. When Is CLV Easy to Calculate?

CLV is easier to calculate in industries with predictable customer behaviours:

-

Easier Sectors: Banking, telecoms, credit cards, insurance (recurring and stable revenue)

-

Harder Sectors: Fashion, groceries, travel (irregular or seasonal purchases)

3. CLV Influencing Factors

Key variables influencing CLV include:

-

Customer retention rate (lifespan)

-

Revenue per customer

-

Referral value

-

Cost of servicing customers

-

Discount rate to reflect inflation/capital cost

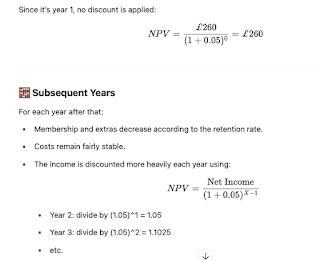

4. CLV Formula (Present Value Basis)

Customer Lifetime Value = Present value of all net margins earned from a customer over time

(Buttle & Maklan, 2019)

Discounting to present value accounts for the time value of money:

Where:

-

r = discount rate (e.g. 5%)

-

X = year of income

5. CLV Cohort-Based Example: Sports Club

| Year | Remaining Customers | Membership Income | Additional Sales | Admin Cost | Retention & Acquisition Cost | Net Income | NPV (5%) |

|---|---|---|---|---|---|---|---|

| 1 | 1.00 | £520 | £100 | £30 | £300 | £260 | £260.00 |

| 2 | 0.85 | £442 | £90 | £30 | £40 | £462 | £410.48 |

| 3 | 0.72 | £374 | £70 | £30 | £40 | £374 | £321.94 |

| 4 | 0.61 | £320 | £50 | £30 | £40 | £300 | £247.10 |

| 5 | 0.52 | £270 | £30 | £30 | £40 | £230 | £201.09 |

-

Total CLV (NPV 5 Years): £1,441

-

Average Annual Return per Customer: £288

6. Assumptions and Considerations

-

Constant annual membership fee: £520

-

Admin and retention costs fixed

-

No price inflation assumed

-

Retention rate: 85%

-

Income includes both direct (fees) and indirect (sales)

7. Preview: Impact of Lower Retention

A recalculation with a 60% retention rate shows a much lower CLV:

| Year | Remaining Customers | Net Income | NPV (5%) |

|---|---|---|---|

| 1 | 1.00 | £260 | £260.00 |

| 2 | 0.60 | £357 | £323.81 |

| 3 | 0.36 | £293 | £252.65 |

| 4 | 0.22 | £237 | £195.00 |

| 5 | 0.13 | £188 | £164.89 |

-

Total CLV (NPV 5 Years): £1,196.35

-

CLV Decrease: £244.65 (–17%) due to 25% drop in retention

8. Customer Referrals and Product Characteristics

According to Buttle and Maklan (2019), customer referrals are a critical factor in customer acquisition and retention. CLV calculations can be significantly impacted by the referral value added by existing satisfied customers. Customers often seek referrals in situations involving:

a. High Cost or Financial Commitment

-

Examples: Travel packages, electronics, vehicles

-

Reason: Greater financial risk → reliance on trusted advice

b. Personal or Emotional Impact

-

Examples: Healthcare, education, life insurance

-

Reason: High involvement → more likely to trust word-of-mouth

c. Hard-to-Evaluate Services

-

Examples: Hotels, salons, service providers

-

Reason: Quality is intangible → peer recommendations are trusted

d. Complex or Technical Products

-

Examples: Software, digital tools, fintech

-

Reason: Users rely on social proof to make sense of complicated offerings

e. Crowded Markets with Low Differentiation

-

Examples: Food delivery apps, cosmetics, clothing

-

Reason: Reviews provide a shortcut to navigate choices

"Customers become advocates when they are satisfied and loyal, and when they believe their recommendations will help others" (Buttle & Maklan, 2019, p. 39).

9. Strategic Insights for Marketers

-

Referrals increase CLV by reducing acquisition costs and bringing in high-value customers

-

Retention marketing should be prioritised, as it stabilises revenue and boosts referrals

-

Segmentation based on referral value can improve ROI on marketing spend

10. Conclusion

This lecture and the associated reading demonstrate the strategic value of CLV as a central CRM metric. As supported by Buttle and Maklan (2019), retention and referral activities aren't just soft marketing goals—they are financially measurable imperatives. Companies that invest in long-term customer relationships and advocacy stand to increase profitability significantly.

Reference

Buttle, F. and Maklan, S. (2019) Customer Relationship Management: Concepts and Technologies. 4th edn. London: Routledge.

Comments

Post a Comment